UAE Insurance Statistics for 2022

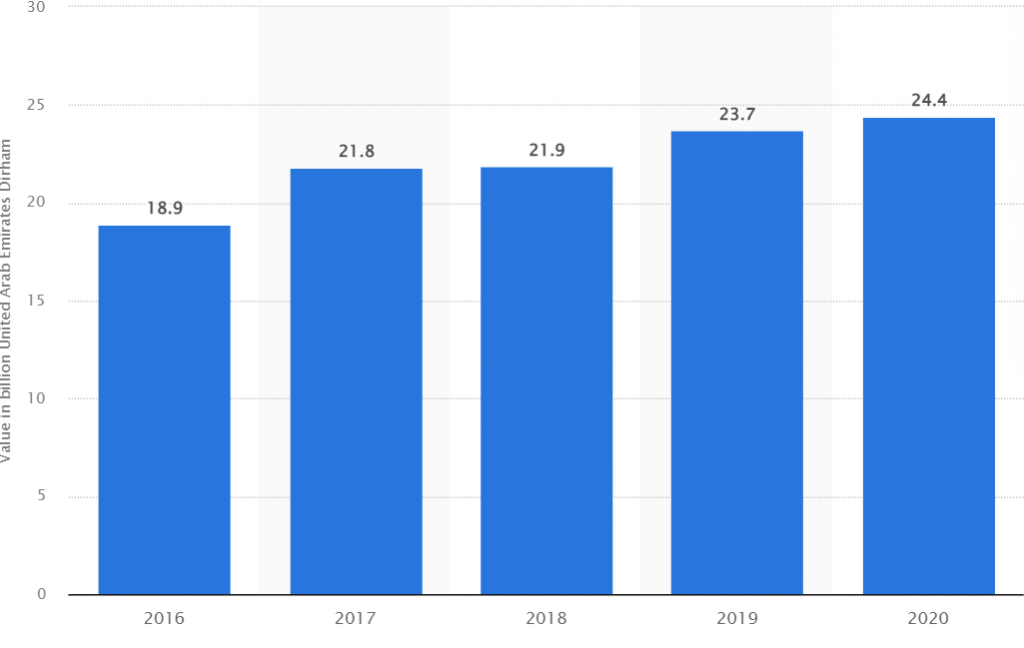

There has been a consistent increase in gross written premium (GWP) value in the UAE insurance market since 2016. Find out why this matters and what’s in store for the industry for 2022.

The insurance industry played a significant role during the pandemic. Many of their clients claimed life insurance due to the impact of COVID-19 on their lives. According to a survey, more than six out of 10 respondents were very or extremely worried about getting a severe illness in the future.

Find out what this means for the industry and what’s in store for the year 2022.

Gross written premium (GWP) of the UAE insurance market from 2016 to 2020 (in billion United Arab Emirates Dirham) Source: Statista

UAE insurance industry after COVID-19

In 2021, the total assets of UAE insurance companies increased by 10.0% to US$12.5 billion, with receivables also experiencing an increase of 42.1% to US$1.7 billion.

Many prominent trends emerged in the industry after the pandemic. Among these are:

Delays in premium settlement and increased risk of default

The impact of the disruption on the overall market is palpable. Many business owners suffered from revenue challenges, leading to delays in premium settlements.

More term life insurance policies

The consumer market in general has also become more aware of the importance of term life insurance, leading to its greater penetration in the UAE region.

Rise in travel insurance prices

With air travel resuming and rising in demand, travel insurance prices also experienced a sudden increase.

Growth in UAE Health Insurance Market in 2022

In 2021, the UAE health insurance market reached an estimated value of US$7.1 Billion. But reports claim that this market will reach US$11.1 Billion by 2027, with a CAGR of 7.5% during the forecast period of 2022 to 2027.

Another report found that Insurance companies in the UAE recorded a business value of AED 9.4 billion (US$2.56 billion) in 2022, depicting a growth of 7% during the first three months of the year compared with the same period of 2021.

However, this market is dominated by five insurance companies which account for nearly 60% of the overall market share.

What’s in store for UAE insurance companies

With the disruptions in the market, how should UAE insurance companies prepare for the challenges ahead?

Support vulnerable clients

Financial support packages must be provided to clients that are unable to promptly pay their premiums. Supplier payments for SMEs must be prioritized. And payment dates must be extended and penalties waived for a period.

Integrate digital technologies

The pandemic accelerated the use of digital technologies to improve the value provided by companies. Those that have integrated digital technologies during and after the pandemic has seen an increase in impact provided across their value chains. For example, AI-based scoring algorithms can be automated to offer clients personalized policies that best match their profiles.

Prepare the workforce

Some employees may opt to remain working securely from remote locations. Those

who can’t work remotely must be provided tools that allow them to engage prospects and clients without contact. Sales and marketing management tools must be used to seamlessly manage teams, prospects, and customers whatever the work setup is for the employees.

Upgrade your insurance company

Looking for ways to enhance your workflows and have an edge in the insurance industry? Talk to our experts at Saphyte and we’ll teach you how you can get started. Book a FREE demo now.

Curious how digital ecosystems can help improve your business?

Check out how digital ecosystems can boost your company performance by getting started here.

Book a Demo